Answer:

Yes, Alaska should pay 1 billion new sol for the acquisition.

Maximum price = 1.616 billion new sol.

Step-by-step explanation:

Asking price by Estoya = 1 billion new sol.

However, estimating the value of Estoya considering the cash flows in years 1 and 2 to Alaska is as follows.

Year 1 cash flow (figures in millions)

- Cash flow (which will grown by 5% yearly) = 500 * 1.05 = 525

- In USD (exchange rate in year 1 = $.29), 525 = 525 * $.29 = $152.25.

Year 2 cash flow (figures in millions)

- Cash flow = 525 * 1.05 = 551.25

- Resale value = 1,200 (i.e 1.2 billion)

- Total year 2 cash flow = 1,751.25

- In USD (exchange rate in year 2 = $.27), 1,751.25 = 1,751.25 * $.27 = $472.84.

Given a discount rate of 18%, the present value of the cash flows

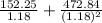

=

= 129.03 + 339.59

= $468.62.

Therefore, the maximum amount Alaska Inc. should pay for the Company is the local currency equivalent of $468.62 in today's price

= 468.62/0.29

= 1.616 billion new sol.

Because this amount (the fair value) is higher that the 1 billion new sol the company intends to pay, Alaska should pay the 1 billion new sol.