Answer:

$9,000 (to the nearest hundred dollars)

Explanation:

Loans from banks are usually amortizing loans, which is a type of loan that requires regular monthly payments.

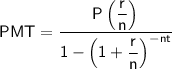

To calculate the regular monthly payment:

where:

- PMT = regular monthly payment

- P = principal

- r = interest rate in decimal form

- n = number of payments per year

- t = length of loan (in years)

Given:

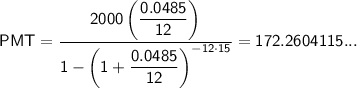

- P = 22000

- r = 0.0485

- n = 12

- t = 15

Number of months in 15 years = 15 × 12 = 180

⇒ Total payment over the term of the loan = 180 × 172.2604115...

= 31006.87406...

Total interest = total payment - principal

= 31006.87406... - 22000

= 9006.87406...

= $9,000 (to the nearest hundred dollars)