Answer:

Explanation:

Given

The attached table

Solving (a): The mean

This is calculated as:

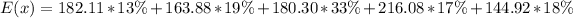

So, we have:

Using a calculator, we have:

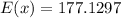

--- approximated

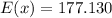

--- approximated

The average opening price is $177.130

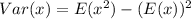

Solving (b): The Variance

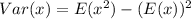

This is calculated as:

Where:

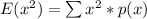

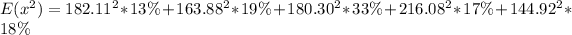

So:

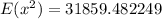

--- approximated

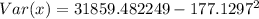

--- approximated

Solving (c): standard deviation

The standard deviation is:

Approximate