Answer:

The correct answer is "$28.03".

Step-by-step explanation:

The given values are:

Good purchase,

= $25

Dividend,

= $1.40

Annually earning,

= 5%

Beta coefficient,

= 1.3

Treasury bills,

= 1.4%

Now,

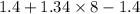

=

=

=

(%)

(%)

hence,

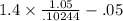

The fair value will be:

=

=

Absolutely, the proposal including its brokerage must be adopted because as fair market value was almost $25.