The question is incomplete. The complete question is :

For a project being considered by a city, the following cost data is available. (a) Determine both the modified and conventional B/C ratios and offer a recommendation, and (b) if you are concerned because the data is not capturing the effects of Estimated annual disbenefits, how large would these have to be in order for you to change your recommendation (if at all) using the conventional B/C ratio?

Initial cost = $10,000,000

O & M cost / year = $450,000

Estimated annual benefits = $850,000

Life = 25 Years

Salvage value = $1 million

MARR = 6%

Solution :

Given :

Initial cost = $10,000,000

Salvage, S = $1,000,000

O and M Cost/year = AOM = $450,000

Benefit per year, AWB = $ 850,000

Equivalent initial cost per year = C

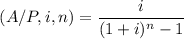

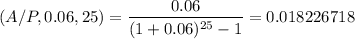

Equivalent salvage per year = S x (A/F, 0.06, 25) = 1,000,000 x (A/F, 0.06, 25)

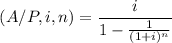

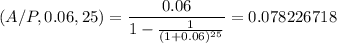

Let us calculate the interest factors,

The equivalent initial cost per year = AWC = 10000000 x 0.078226718 = $ 782267.18

Equivalent salvage per year, AWS = 1,000,000 x 0.018226718 = $ 18226.72

Conventional B-C ratio = AWB/(AWC-AWS+AOM)

= 850000/(782267.18-18226.72+450000)

= 0.7001

Modified B-C ratio = (AWB-AOM)/(AWC-AWS)

= (850000-450000)/(782267.18-18226.72)

= 0.5235

In this case. both the conventional B-C ratio and modified B-C ratio are less than 1, the project is not acceptable.