Answer:

This machine is not economical. A further explanation is provided below.

Step-by-step explanation:

Given:

First cost,

= $20,000

Saving,

= $1500

Increase by,

= $200

Decrease by,

= $150

Now,

The EUAW will be:

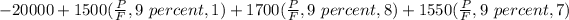

=

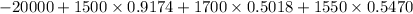

=

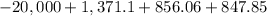

=

=

($) negative

($) negative

Thus this machine is not economical.