Answer:

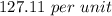

"$127.11 per unit" is the correct approach.

Step-by-step explanation:

The activity cost as per the questions will be:

Activity 1:

=

=

($)

($)

Activity 2:

=

=

($)

($)

Activity 3:

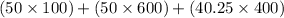

=

=

($)

($)

Now,

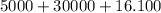

The overhead cost for digital cameras will be:

=

=

=

($)

($)

Per unit overhead cost will be:

=

=

($)

($)

hence,

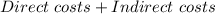

The total cost will be:

=

=

=

($)

($)