Answer:

a) $161.8

b i) Approximately 327.7 hours

ii) The cost of saving is less but the opportunity cost of saving can be higher with regards to technology and regulation

Explanation:

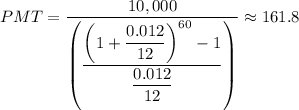

The amount Mary would like to save, FV = $10,000

The time Mary over which Mary intends to save the amount, t = 5 years

Therefore, the number of monthly payments, n = 12

a) The amount in interest the bank pays compounding, i = 1.2% per annum

The amount that Mary will deposit each month is given as follows;

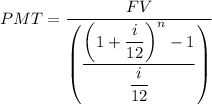

The compound interest formula is given as follows;

Where;

PMT = The monthly payment

Therefore, we get;

PMT = 10,000/((1 + 0.012/12)^(60) - 1)/(0.012/12)) ≈ 161.8

The amount she needs to deposit monthly, PMT ≈ $161.8

b i) Given that the minimum wage varies and we have a minimum wage here is officially approximately $79, which is 160 hours a month work

The number of hours work needed = 161.8/79 × 160 ≈ 327.7 hours a month approximately

b ii) Given that the interest rate for saving is lower than the interest rate for borrowing, the amount paid by saving is much lesser than the amount paid back when borrowing, therefore, it is more cost effective to save

However, while saving, changes may take place, such as the use of what is being saved for, therefore, it can be more beneficial to borrow and make use of the items now while they are still available and acceptable, such as the drive towards net zero is making fuel based cars less popular with the drive being towards electric cars.