Answer:

The answer is "Option 4".

Step-by-step explanation:

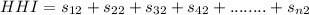

The Herfindahl-Hirschman Index formula:

here sn is the firm n's share of the market proportion represented the society in general number instead of a decimal

Index Herfindahl-Hirschman:

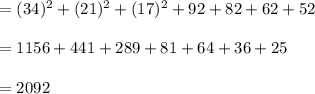

Index Herfindahl-Hirschman(Result of the merger, firms with profit margins of 6% and 5% provided market shares of respectively).

The market with just an HHI of less than 1,500 is called a competitive industry, one on an HHI of 1,500 to 2,500 is called a moderately competitive store, and one on an HHI of 2,500 or higher is considered a highly potent store by us Justice department.

All businesses operate in a moderately crowded market, as well as a merger such as this reduces competition (increases chances of monopoly). Also as result, the Justice Dept may examine its merger but will most likely deny this because the Herfindahl-Hirschman index has risen.