Solution :

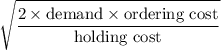

The optimal order quantity, EOQ =

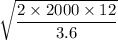

EOQ =

= 115.47

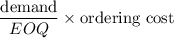

The expected number of orders =

= 17.32

The daily demand = demand / number of working days

= 8.33

The time between the orders = EOQ / daily demand

= 13.86 days

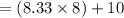

ROP = ( Daily demand x lead time ) + safety stock

= 76.64

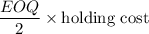

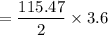

The annual holding cost =

= 207.85

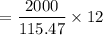

The annual ordering cost =

= 207.85

So the total inventory cost = annual holding cost + annual ordering cost

= 207.85 + 207.85

= 415.7