Answer:

Step-by-step explanation:

From the given information:

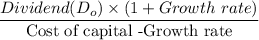

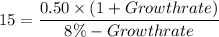

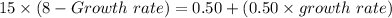

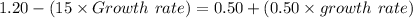

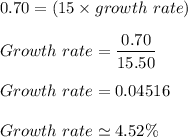

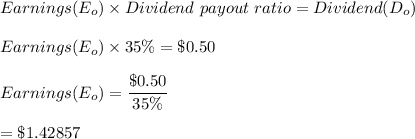

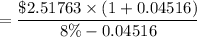

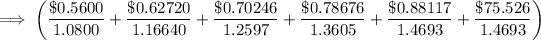

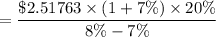

The current price =

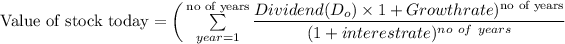

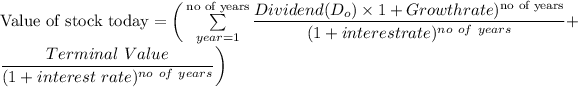

2. The value of the stock

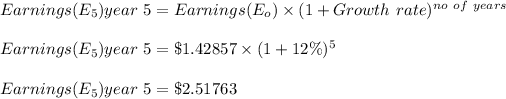

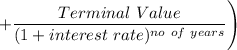

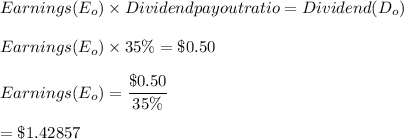

Calculate the earnings at the end of 5 years:

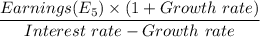

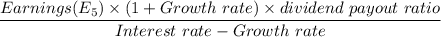

Terminal value year 5 =

=$75.526

Discount all potential future cash flows as follows to determine the stock's value:

=$ 54.1945

As a result, the analysts value the stock at $54.20, which is below their own estimates.

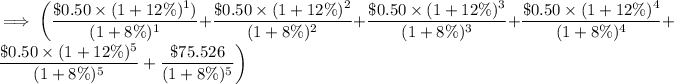

3. The value of the stock

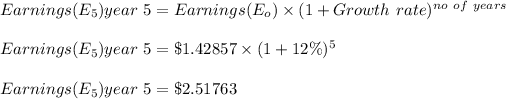

Calculate the earnings at the end of 5 years:

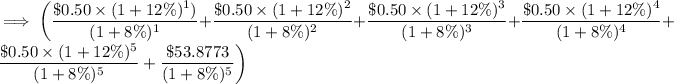

Terminal value year 5 =

=$53.8773

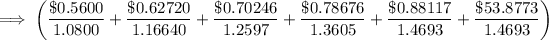

Discount all potential cash flows as follows to determine the stock's value:

=$39.460

As a result, the price is $39.460, and the other strategy would raise the value of the shareholders. Not this one, since paying a 100% dividend would result in a price of $54.20, which is higher than the current price.

Notice that the third question depicts the situation after 5 years, but the final decision will be the same since we are discounting in current terms. If compounding is used, the future value over 5 years is just the same as the first choice, which is the better option.

The presumption in the second portion is that after 5 years, the steady growth rate would be the same as measured in the first part (1).