Answer:

(a)$1455.77

(b)$387.97

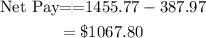

(c)$1067.80

Step-by-step explanation:

(a)Manuel's proposed annual income = $37,850

There are 52 weeks in a year, this means that if he is paid bi-weekly (every two weeks), he will receive his salary 26 times a year.

His Biweekly pay will be:

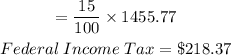

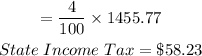

(b)

Federal Income Tax = 15% of his gross pay

State Income Tax = 4% of his gross pay

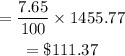

Social Security and Medicare taxes = 7.65% of his gross pay

The total taxes paid will be:

(c)

Therefore, his net pay (take-home pay) will be: