Answer:

Difference in total payback = $5734.64

Explanation:

Formula for the simple interest payout,

Interest =

P = Principal amount of loan

r = rate of interest (Annually)

t = Duration for the payment

Interest =

= $13050

Total payable amount = 18000 + 13050

= $31050

Formula for the amount payable with compound interest,

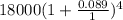

Final amount =

Here, t = Duration of investment

r = rate of interest (Annual)

n = Number of compounding per year

Payable amount =

= 18000(1.089)⁴

= $25315.36

Difference in total payback = $31050 - $25315.36

= $5734.64