Answer:

Given that,

Jason earns $670 weekly at his job at a local newspaper.

To find the weekly taxes for Jason’s salary.

tax rate is 27.2%

we get,

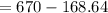

Weekly taxes for Jason’s salary is,

Weekly taxes for Jason’s salary is $168.64

Take home pay is, (per week)

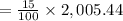

Take home oay for a month is,

Take home pay for a month is $2,005.44.

Given that,

If Jason wishes to purchase a car where his payments are no more than 15% of his take home pay for a month.

15% of his take home pay for a month is,

we get that, Jason wishes to purchase a car where his payments are no more than $300.816.

Therefore, the maximum monthly car payment he can afford is $300.816.