Andres salary is $59,800 per year.

He is paid bi-weekly. (bi-weekly means 2 times in a week)

The taxes are as follow

Federal income tax = 15%

State income tax = 4%

Social Security and Medicare taxes = 7.65%

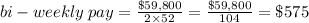

Part A. Convert the annual pay to bi-weekly.

We know that there are 52 weeks in a year and bi-weekly means 2 times in a week so

Therefore, the bi-weekly salary of Andres is $575.

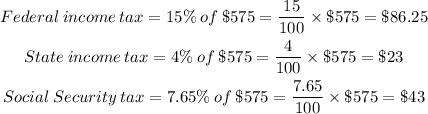

Part B. How much money will he pay in taxes each paycheck?

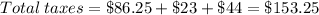

Now add up the amount of taxes

Therefore, he will pay $153.25 in taxes each paycheck.

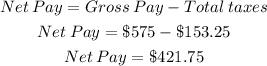

Part C. What is the net pay?

The net pay is the pay after deducting the taxes

So, subtract the total taxes from the gross pay

Therefore, the net pay is $421.75.