Financial Maths

A sequence of equal payments (or deposits) at equal periods of time is called an annuity.

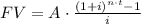

The future value of an annuity can be calculated with the formula:

Where:

FV is the future value of the annuity

A is the periodic deposits

n is the number of compounding periods per year

i is the interest rate adjusted to the compounding periods. i = r/n where r is the APR.

t is the duration of the investment in years

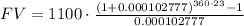

The financial variables for this investment are:

A = $1100

r = 3.7% = 0.037

n = 360. Daily compounding

i = 0.037/360 = 0.000102777

It's crucial to keep as many decimals as possible in the calculations.

Applying the formula:

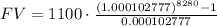

Calculating:

FV = $14,361,798.98

Calculation steps (in strict order)

* Add 1 + 0.00010277 = 1.00010277

* Multiply 360*23 = 8280

* Raise 1.00010277^8280 = 2.341885

* Subtract 1 = 1.341885

* Divide by 0.00010277 = 1.341885/0.00010277=13056.18

* Multiply by 1100: $14,361,798.98

Rounded to the nearest cent