We can write 2 equations from the information given.

Let the amount invested in CD be "x" and the amount invested in bond be "y".

The total amount invested is $600,000. Thus, we can write,

The CD pays 2% (0.02) and the bond pays 8.5% (0.085). Total interest needed is $27,000. Thus, we can craft another equation,

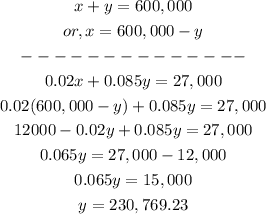

Solving the first equation for "x", we can substitute it into the second equation and solve for "y" first. The steps are shown below:

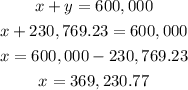

Now, we can find "x",

Rounded to the nearest dollar, we write our answer >>>

$369,231 at 2%$230,769 at 8.5%