Data:

Cost of the bike: $89.00

Salex tax California: 7.5%

Sales tax in Ohio: 7%

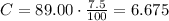

1. As the bike cost without tax $89.00 to find how much will she pay in taxes in California (C) you find the 7.5% of $89.00:

In California she pays in tax $6.675

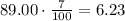

2. As the bike has the same cost $89.00 to find how much she will save purchasing the bike in Ohio you:

- calculate the 7% of $89.00

In Ohio she pays in tax $6.23

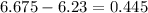

- Find the difference between the tax she pays in California and the tx she pay in Ohio:

If she purchase the bike in Ohio she will save $0.445