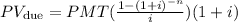

We are asked to determine the present value of an annuity that is compounded monthly and needs to be paid at the beginning of the time period. To do that we will use the following formula:

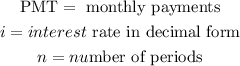

Where:

Now, the PMT is $850 since this is the required amount for each period. The interest rate in decimal form is:

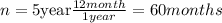

The number of periods "n" is the number of months is 5 years, since there are 12 months per year, then in five years we have:

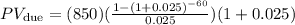

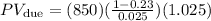

Now we replace the values in the formula:

Now we solve the operations and we get:

Solving the operations:

Therefore, the investment must be $26929.17.