Given:

Two intercept points be (-2,0) and (4,0) and passing through the point (1,-27).

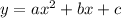

Let the equation of parabola be

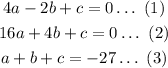

Substituting the points we get,

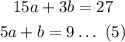

Solving (1) and (2) we get,

Solving (2) and (3) we get,

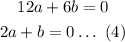

Solving (4) and (5)

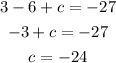

Substituting a=3 in (4)

Substitute a=3 & b=-6 in (1)

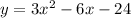

Equation of parabola is