A trader sold 100 boxes of fruits at GH¢ 8.00 per box. 8 boxes at GH¢ 6.00 per box and 600 boxes at GH¢ 4.00 per box.

I) Calculate the total sales the trader obtained from the fruits.

II) Calculate the average selling price per box

Step 1

price=number of boxes * the price of a box

100 boxes of fruits at GH¢ 8.00 per box

price1=100*GH¢ 8.00

price1= GH¢ 800

8 boxes of fruits at GH¢ 6.00 per box

price2=8*GH¢ 6

price2= GH¢ 48

600 boxes of fruits at GH¢ 4.00 per box

price3=600*GH¢ 4

price3= GH¢ 2400

i)total sales=price1 +price2+price 3

i) total=GH¢ 800 +GH¢ 48 + GH¢ 2400

i) Total sales GH¢ 3248

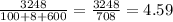

ii)average selling price

to do this just, divide the total amount of money by the total of boxes

so,

ii) the average selling price is GH¢ 4.59