Answer:

$4,664

Step-by-step explanation:

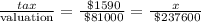

If the property tab varies directly as assessed valuation, the ratio of the tax to the assessed valuation is constant, so we can formulate the following equation:

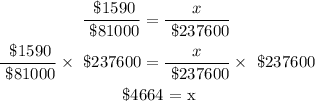

Where x is the property tax of the apartment complex. So, we can solve for x as follows:

Therefore, the property tax is $4,664.