We have a purchase at a price of $997.

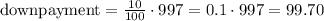

The downpayment is 10%, so it represents $99.70

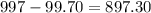

Then, the amount that is financed is:

We then can calculate the monthly payments using the annuity formula.

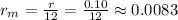

As there are monthly payments, we have to calculate a monthly interest rate:

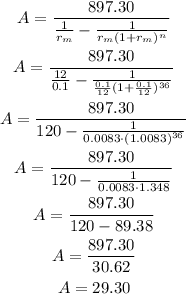

Then, the monthly payment will be:

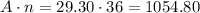

We can calculate the total financed payments as:

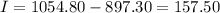

The finance charge will be the difference between the total financed payments and the financed value:

Answer: Finance charge = $157.50