The amount kiera put into the account is 1000.00

Rate of interest is 13%

Time period is 4 years

Compound interest is calulated annully

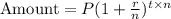

The expression for thr compound interest is

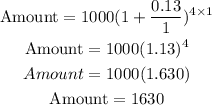

From the given data, we have

P=1000, n=1, t=4 and r=13% or r=0.13

Substitute this value to find the net amount

The net amount Kiera have in her account is 1630.