Answer:

The correct answer is "10,000".

Step-by-step explanation:

The given values are:

Fair market value,

= $300,000

Andrew's adjusted basis,

= $190,000

Its fair market value,

= $250,000

Steve's mortgage,

= $120,000

Andrew's mortgage,

= $70,000

According to the question,

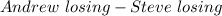

Steve is losing out,

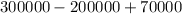

=

=

Andrew is losing out,

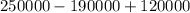

=

=

Now,

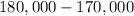

Steve gains the amount,

=

=

=

So that Andrew loses the same amount as Steve i.e.,

= 10,000