Answer:

the current market value of this stock is $15.96

Step-by-step explanation:

given

current earnings = $1.96 per share

growth rate = 2.2 percent

return on the stock = 13 percent

current book value = $12.70 per share

solution

first we get here return on equity that is

return on equity = [ current earning per share × ( 1 + growth ) ] ÷ book value per share ....................1

return on equity =

return on equity =15.77 %

and

now we get here payout ration that is

growth rate = retention ration × ROE ....................2

put here value

2.2% = (1 - payout ratio ) × 15.77

payout ratio = 86.05 %

and

now we get here current dividend per share that is

current dividend per share = current earning per share × payout ratio ...........3

put here value

current dividend per share = 1.96 × 86.05 %

current dividend per share = $1.6865

and

now we get here current market value

current market value = [ current dividend per share × ( 1 + growth ) ] ÷ [ required return - growth rate] ....................1

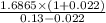

current market value = [Text]\frac{1.6865 \times (1+0.022)}{0.13-0.022}[text]

current market value =

current market value = $15.96