Answer:

The correct answer is:

(1) $15,054

(2) $12,990

Step-by-step explanation:

The required table is not given in the question. Please find below the attachment of the table.

Given:

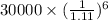

Future value,

= $30,000

If discounting rate is 9%, the present value will be:

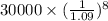

=

=

=

=

($)

($)

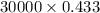

If discounting rate is 11%, the present value will be:

=

=

=

=

($)

($)