≈≈≈Answer:

Explanation:

To calculate the total amount Karl will pay to the bank, we need to find the monthly payment and then multiply it by the total number of payments over three years.

First, we need to calculate the monthly interest rate. Since the loan is compounded monthly, we divide the annual interest rate by 12:

Monthly interest rate = 7.25% / 12 = 0.006041667

Next, we need to calculate the total number of payments Karl will make over the course of the loan. Since he will be making monthly payments for three years, there will be a total of:

Total number of payments = 3 years x 12 months/year = 36 payments

To calculate the monthly payment, we can use the formula for the present value of an annuity:

Monthly payment = P * (r / (1 - (1 + r)^(-n)))

where P is the principal amount (in this case, $5000), r is the monthly interest rate, and n is the total number of payments.

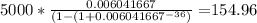

Plugging in the values, we get:

Monthly payment =

Finally, we can calculate the total amount Karl will pay to the bank by multiplying the monthly payment by the total number of payments:

Total amount paid = Monthly payment x Total number of payments = $154.96 x 36 = $5,578.56

Therefore, the total amount Karl will pay to the bank is $5,578.56