Ming's at-risk amount at the end of the year is $23,425.

The at-risk amount in an investment is the amount a taxpayer can potentially lose in that investment.

It is used to determine the deductible loss for tax purposes.

The formula for calculating the at-risk amount is:

At-Risk Amount=Initial Investment+Additional Contributions−Withdrawals−Allocable Share of Losses

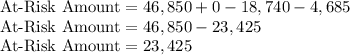

In this case, Ming's initial investment is $46,850, he has taxable income of $4,685 from the oil partnership, and he withdraws $18,740.

So, Ming's at-risk amount at the end of the year is $23,425.