Final answer:

After 10 years, $2000 invested at 7% annual interest compounded annually will become approximately $3937.70 and compounded continuously it'll be approximately $4030.23. To double the investment with annual compounding takes approximately 10.24 years, and with continuous compounding, it's approximately 9.90 years.

Step-by-step explanation:

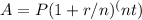

When $2000 is invested in an account with a 7% annual interest rate compounded annually, we use the compound interest formula to determine the amount in the account after 10 years:

. Here, P is the principal amount ($2000), r is the annual interest rate (0.07), n is the number of times interest is compounded per year (1 for annually), t is the number of years (10).

. Here, P is the principal amount ($2000), r is the annual interest rate (0.07), n is the number of times interest is compounded per year (1 for annually), t is the number of years (10).

Compound Interest Annually

For part a, substituting our values in we get:

approximately after 10 years.

approximately after 10 years.

Compound Interest Continuously

For part b, the formula for continuously compounded interest is A =

. Substituting our values, we get:

. Substituting our values, we get:

approximately after 10 years.

approximately after 10 years.

Doubling Time with Annual Compounding

For part c, we need to solve for t in the equation

, which gives us

, which gives us

0. Using logarithms, t = log(2) / log(1.07) = 10.24 years approximately.

0. Using logarithms, t = log(2) / log(1.07) = 10.24 years approximately.

Doubling Time with Continuous Compounding

For part d, we use the continuous compounding formula and solve for t in the equation

, which gives us 2000e^(0.07t) = 4000. This simplifies to t = (log(2) / 0.07) = 9.90 years approximately.

, which gives us 2000e^(0.07t) = 4000. This simplifies to t = (log(2) / 0.07) = 9.90 years approximately.