Given:

The market value is $400,000.

The assessed value rate = 70 %=0.7.

The property tax rate is $50 per $ 1000 of assessed value.

Required:

We need to find the property tax amount.

Step-by-step explanation:

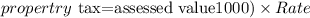

Consider the assessed value formula.

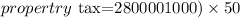

Substitute rate =70 %=0.7 and market value =400000 in the formula.

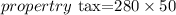

Consider the property tax amount formula.

Substitute assessed value = 280000 and rate =50 in the formula.

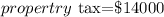

Final answer: