Step 1. Gather all of the information.

We have the Principal P:

The total amount A for the loan's future value:

And the time t in moths:

We are going to need the time in years, so we consider that 9 months are 9/12 of a year:

Which can be simplified to 3/4 of a year:

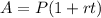

Step 2. Remember the simple interest formula:

From this formula, we will need to find the simple interest rate r, so we will solve for r.

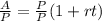

-The first step to solve for r is to divide both sides by P:

on the right-hand side P/P is 1 so we are left only with 1+rt:

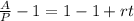

-the second step to solve for r is to subtract 1 to both sides:

On the right-hand side, 1-1 cancels each other:

-the last step to solve for r is to divide both sides by t:

This is the equation we will use to find the value of r.

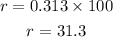

Step 3. Substitute the known values into the formula to find r:

We have substituted the values of A, P and t.

Simplifying the fractions:

Solving the final operations:

This is the simple interest rate represented in decimal form, to convert it to percentage, we need to multiply the result by 100:

The final result is 31.3%

Answer:

the simple interest rate to the nearest tenth is:

31.3%