Step-by-step explanation:

We are given a zero-coupon bond that will be worth $10,000 if redeemed in 20 years time at an annual rate of 8% compounded;

(a) Daily

(b) Continuously

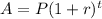

The formula for compounding annually is given as follows;

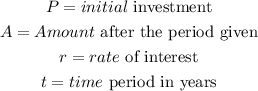

Here the variables are;

Note that this zero-coupon bond will yield an amount of $10,000 after 20 years at the rate of 8%. This means we already have;

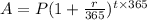

(a) For interest compounded daily, we would use the adjusted formula which is;

This assumes that there are 365 days in a year.

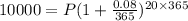

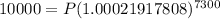

We now have;

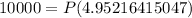

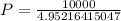

Now we divide both sides by 4.95216415047;

We can round this to 2 decimal places and we'll have;

(b) For interest compounded continuously, we would use the special formula which is;

Note that the variable e is a mathematical constant whose value is approximately;

With the use of a calculator we have the following value;