SOLUTION

Given the question in the question tab, the following are the solution steps to calculate the amount to be deposited

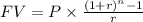

STEP 1: Write the formula for Future value annuity

Where:

FV = present value of an ordinary annuity

P=value of each payment

r=interest rate per period

n=number of periods

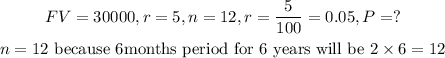

STEP 2: Write the given parameters

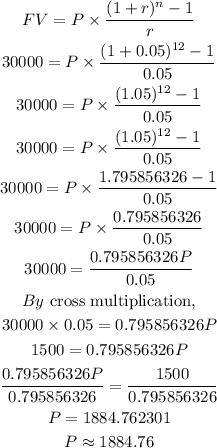

STEP 3: Calculate the P

Hence, the amount that must be deposited now is approximately 1884.76 to the nearest cents