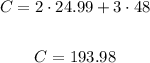

First, let's calculate the total price without discount or taxes:

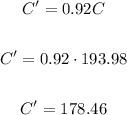

Now, to apply a discount of 8%, we can multiply the cost by 92%, that is, 0.92:

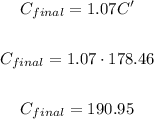

And then, to apply a tax of 7%, we can multiply the cost by 107%, that is, 1.07:

Therefore the correct option is A.