When the interest is compounded monthly, we have to do two things:

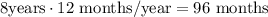

- Calculate the number of periods: in this case we have 8*12=96 months.

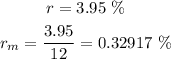

- The monthly interest rate: we have to divide the annual nominal rate by 12 (the number of periods in the year).

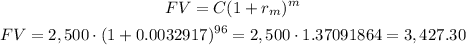

Then, we can calculate the future value as:

The future value when compounded monthly is $3,427.30.

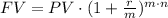

General formula:

m: number of subperiods (monthly --> m=12)