Given:

There are given that the initial amount, time period, and rate are:

Step-by-step explanation:

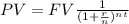

To find the present value, we need to use the present value formula:

So,

From the formula of present value:

Then,

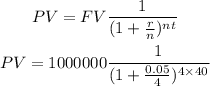

Put all the given values into the above formula:

So,

Then,

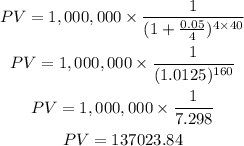

Final answer:

Hence, the amount is $137023.84