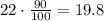

a. How much does the firm currently earn per share?

Since, the firm it's going to retain 90% of its earnings, then:

The firm earns $19.8 per share.

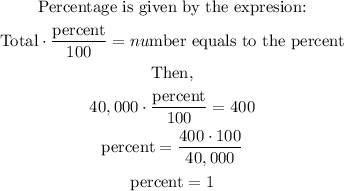

b. What proportion of the firm does currently own?

The firm has 40,000 shares and Sarah currently holds 400, so

Sarah owns 1% of the shares.

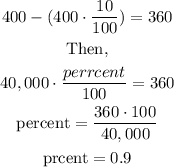

c. What proportion of the firm will Sarah own after the stock dividend?

Sarah will own 0.9% of the shares.

d. At what market price would you expect the stock to sell after the stock dividend?