Answer:

$17.99

Step-by-step explanation:

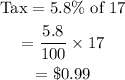

Item cost = $17

Sales tax = 5.8%.

First, calculate the tax to be paid on the item.

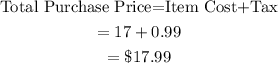

Next, calculate the total purchase price by adding the item cost and the tax.

The total purchase price is $17.99 rounded to the nearest cent.