Given:

Face value, P = $10000

Time, t = 10 years

Rate, R = 6.4% = 0.064

Let's solve for the following:

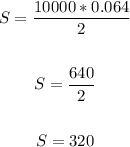

• 1) Calculate the semi-annual interest payments.

Apply the formula:

Thus, we have:

The semi-annual interest payment is $320

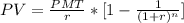

• (2) Calculate the present value of the payments.

To find the present value, apply the formula:

Where:

r = 0.065/2 = 0.0325

n is the number of periods = 10 x 2 = 20

PMT = 320

Thus, we have:

The present value of the payments is $4652.59

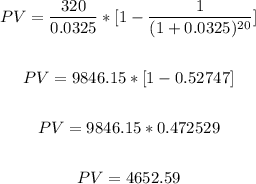

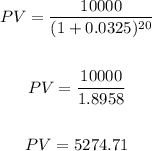

3) Calculate the present value of the bond at maturity.

Take the formula:

Thus, we have:

The present value of the bonds at maturity is $5274.71

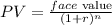

• 4) Find the price of this bond.

To find the price f this bond, we have:

Price of bond = Present value of payments + Present value at maturity

Price of bond = $4652.59 + $5274.71

Price of bond = $9927.30

The price of this bond is $9,927.30

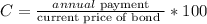

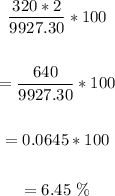

5) To find the current yield, apply the formula:

Thus, we have:

The current yield is 6.45%

ANSWER:

1) $320

2) $4,652.59

3) $5,274.71

4) $9,927.30

5) 6.45%