a.

Annual pay = $42.100

Semi monthly pay = 42.1/24 = $1.754

b.

Total Tax percentage = 17 + 4.5 + 7.65

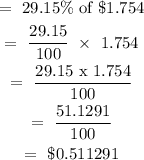

= 29.15%

Taxes for each paycheck

c.

Total Annual tax payment = 24 x $0.511291

= $12.27

Net pay = annual payment - total annual tax

= $42.1 - $12.27

= $29.83