The rule of the compounded continuously interest is

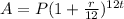

The rule of the compounded monthly interest is

A is the new amount

P is the initial amount

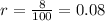

r is the rate in decimal

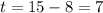

t is the time in years

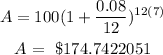

Since the initial amount is $100, then

Since the interest rate is 8%, then

Since the time is from 8 years old to 15 years old, then

a)

Substitute these values in the second rule above

You will receive about $174.74

b)

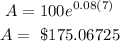

Substitute these values in the first rule

You will receive about $175.07