we have that

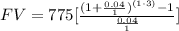

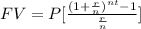

The formula for the future value of an ordinary annuity is equal to:

where

FV is the future value

P is the periodic payment

r is the interest rate in decimal form

n is the number of times the interest is compounded per year

t is the number of years

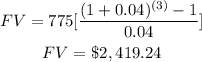

In this problem we have

P=$775

n=1

r=4%=0.04

Part a

t=1 year

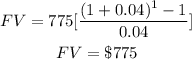

substitute

simplify

For the first year is the same amount

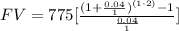

Part b

For t=2 years

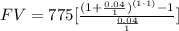

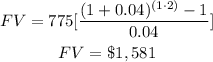

Part c

For t=3 years