Answer: C. 12.25% compounded monthly

Explanation:

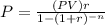

Since, the monthly payment formula for a loan is,

Where PV is the principal value of the loan,

r is the rate per month,

n is the number of months,

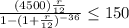

Here, PV = $ 4,500, n = 36,

Let r be the annual rate of interest,

P ≤ 150

⇒

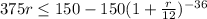

⇒

⇒

Thus, the greatest annual interest rate = 0.1225 = 12.25 %

⇒ Option C is correct.