The question will be solved using the present value of annuity formula.

Now, since he made a down payment of $500, The amount left to be paid is given $9,500 - $500 = $9,000.

The present value of annuity is given by:

![PV=P\left[ (1-\left(1+(r)/(t)\right)^(-nt))/( (r)/(t) ) \right]](https://img.qammunity.org/2019/formulas/mathematics/college/8yvxcwdtzpmp67minha2o3v8kpkxs1rbwl.png)

where: PV = $9,000; P = $365; t = 12 payments per year, n = 3 years; r = APR and

![\left[ (1-\left(1+(r)/(t)\right)^(-nt))/( (r)/(t) ) \right]](https://img.qammunity.org/2019/formulas/mathematics/college/fglhrgg8d6wbas0scsg6qx2qsx6v3ch5xs.png)

is the Present value of annuity factor for

periods at

interest rate per period.

Here, there are 3 years x 12 monthly payments = 36 periods.

Thus,

![9000=365\left[ (1-\left(1+(r)/(12)\right)^(-3*12))/( (r)/(12) ) \right] \\ \\ \Rightarrow \left[ (1-\left(1+(r)/(12)\right)^(-36))/( (r)/(12) ) \right]= (9000)/(365) =24.657534](https://img.qammunity.org/2019/formulas/mathematics/college/asgi9m3k7hdv6efqeh6pn8qbp3awlic74g.png)

This means that the present value of annuity factor is 24.657534.

Using the present value of annuity table, the present value of annuity facot for 36 periods at 2% interest rate per period is 25.488842 and at 3% is 21.832253.

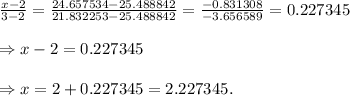

Let the interest rate that give the present value of annuity factor of 24.657534 be x, then interpolating, we have:

Let

, then we have:

Thus, the interest rate per period (r/12) = 2.227345%.

Therefore, the APR = 12 x 2.227345 = 26.7281 ≈

26.7%