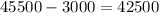

Total annual gross income = $45500

Total exemptions = $3000

So, total taxable income =

For an amount up to $2500, rate of interest = 1.5%

So ,

= 37.50

= 37.50

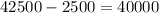

For amount above $2500, rate of interest is = 3%

Hence, amount to be calculated on 3% is

So 3% of 40000 =

=1200

=1200

Hence, total tax becomes =

= 1237.50

= 1237.50

Hence annual tax is $1237.50