Answer: The NPV of the project is $17,080.63.

We follow these steps to arrive at the NPV

We first need to calculate the Present value of the cash flows of each of the years.

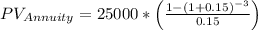

Since the project yields $25,000 in each of the three years we can treat the $25,000 as an annuity for 3 years and discount it at 15% to find the Present Value.

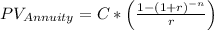

We use the following formula for this:

Substituting the values we get,

Next, we calculate NPV as follows: