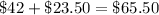

First, let's find how much she will need to pay without tax. She is buying 2 shirts at $21 each (which costs $42 in total) and a pair of pants for $23.50, meaning that her subtotal is:

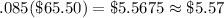

Now, let's apply a sales tax of 8.5%. To do this, we are going to need to find the balance of the tax, which we can then add to the subtotal. The balance of the tax is:

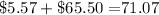

Adding this to the subtotal, we get:

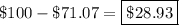

Now, we know the total cost she is going to have to pay is $71.07. Thus, using a $100 bill, she is going to have to pay:

She is going to have to pay $28.93.