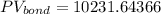

Answer: The Present Value of the bond is $10,231.64.

We have

Face Value of the bond $10000

Coupon rate per year 5.5%

Frequency of int payments Semi-Annual (two periods in a year)

Discount rate per year 5.2%

No. of years to maturity 10 years

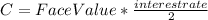

First we calculate the coupon interest per period

We can think of a bond as an instrument have types of cash flows.

One is the coupons we receive from a bond, where we receive a fixed amount per period for a stated number of periods.

An instrument that gives a fixed amount per period for a stated number of periods is known as an annuity.

Hence we can treat the coupon from the bonds as an annuity.

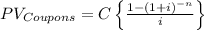

The Present Value formula for an annuity is:

where

C = Coupon per period

i = discount rate per period

n = number of periods

In this question, we'll get

coupon payments, so the number of periods, n = 20.

coupon payments, so the number of periods, n = 20.

The discount rate per period (i) is

or 2.6% per period.

or 2.6% per period.

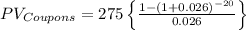

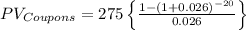

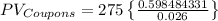

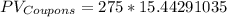

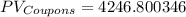

Applying these values to the equation above we can find the PV of Coupons as:

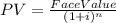

In addition to the coupon, we also get back the bond's face value at the end of the bond's life. We can treat this as a lump-sum amount we will get back at the end of a stated number of periods. We can find the Present Value of the lumpsum as follows:

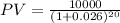

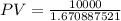

Substituting the values we get,

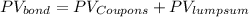

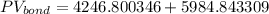

Finally, we compute the Present Value of the bond as follows: