Price of item before tax = $4

Price of item after tax = $4.32

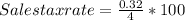

Difference = Price of item after tax-Price of item before tax= 4.32 - 4 = 0.32

Difference in price = $0.32

Now we have to find sales tax rate.

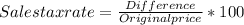

Sales tax rate if given by dividing the difference in price by original price and multiplying it by 100.

Sales tax rate = 8%

Answer: The sales tax rate of the item is 8%.